- Abstract

Blockchain technology, initially synonymous with cryptocurrencies like Bitcoin, has evolved into a multifaceted innovation with far-reaching implications across industries. This abstract explores the benefits of investing in blockchain technology, highlighting its transformative potential in areas such as finance, supply chain management, healthcare, and beyond. Conducting a comparative analysis of investments on blockchain landscape versus traditional finance instruments offers valuable insights into their distinct benefits and challenges. While traditional finance has historically been the bedrock of investment strategies, the emergence of blockchain technology introduces innovative paradigms that redefine established norms.

- Transparency and Trust

- Efficiency and Cost Savings

- Security and Data Integrity

- Improved Traceability and Compliance

- Innovation and Disruption

- Diversification and Portfolio Hedging

- Regulatory Compliance and Risk Management

Blockchain's decentralized nature eliminates the need for intermediaries, fostering trust through transparent and immutable record-keeping. Token holders can leverage this feature to streamline transactions, reduce fraud, and enhance accountability. Blockchain investments offer unparalleled transparency and trust through decentralized ledger technology, whereas traditional finance often relies on centralized intermediaries. While traditional systems provide regulatory oversight and familiarity, blockchain's transparency mitigates counterparty risk and enhances token holders’ confidence.

By automating processes and eliminating manual reconciliation, blockchain can significantly reduce operational costs for businesses. Smart contracts, self-executing agreements coded on the blockchain, enable automated transactions, cutting down on time and resources traditionally required for contract management. Blockchain investments streamline processes and reduce costs through automation and elimination of intermediaries, contrasting with the relatively labor-intensive and costly nature of traditional finance transactions. While traditional systems may offer established infrastructures, blockchain's efficiency drives operational savings and accelerates transaction speeds.

Blockchain's cryptographic features ensure that data stored on the ledger is tamper-proof and secure. This heightened security not only protects sensitive information but also mitigates the risk of data breaches and cyber attacks, a critical consideration in today's digital landscape. Blockchain investments prioritize security and data integrity through cryptographic protocols and decentralized consensus mechanisms, offering robust protection against fraud and cyber threats. Traditional finance, while employing security measures, remains susceptible to centralized points of failure as well as cyber attacks.

In industries such as finance and energy trading, blockchain enables end-to-end traceability of transactions and assets. This enhanced transparency not only facilitates compliance with regulatory requirements and standards but also helps to mitigate issues like fraudulent transactions and resource mismanagement.

Investing in blockchain opens doors to disruptive innovation, fostering the development of novel applications and business models. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), blockchain continues to inspire groundbreaking solutions that challenge traditional paradigms. While traditional finance offers stability and institutional support, blockchain's potential for innovation attracts forward-thinking investors seeking high-growth opportunities through cutting-edge solutions like DeFi and NFTs.

Including blockchain assets in investment portfolios can serve as a diversification strategy, offering exposure to a rapidly growing asset class with low correlation to traditional markets. As blockchain matures, it presents opportunities for long-term growth and portfolio hedging against economic uncertainties. Both blockchain and traditional finance investments offer diversification benefits, albeit with different risk profiles and correlations to traditional markets. While traditional finance provides stability and liquidity, blockchain assets offer diversification against systemic risks and exposure to emerging markets.

Traditional finance investments adhere to established regulatory frameworks and compliance standards, providing participants with a sense of protection and market stability. In contrast, blockchain investments must navigate a rapidly evolving regulatory landscape, where laws and guidelines vary significantly across jurisdictions. While blockchain fosters innovation, it also presents unique compliance challenges, blockchain projects must proactively balance the pursuit of innovation with strict regulatory adherence to mitigate legal risks and ensure long-term sustainability.

Investing in blockchain technology offers a myriad of benefits ranging from enhanced transparency and efficiency to heightened security and innovation. As businesses and industries increasingly recognize the value proposition of blockchain, strategic investments in this transformative technology have the potential to unlock significant value and drive sustainable growth in the digital economy. These motivate the idea of TNQ Token. The option between blockchain and traditional finance investments depends on token holders' risk tolerance, investment objectives, and appetite for innovation. Integrating blockchain technology into traditional finance not only preserves the stability and regulatory certainty inherent in traditional methods but also introduces transformative opportunities for efficiency, transparency, and innovation. By harmonizing these elements, token holders stand to benefit from a comprehensive approach that optimizes risk-adjusted returns and capitalizes on the evolving global financial landscape. TNQ is dedicated to democratizing access to these integrated investment strategies for widespread participation and opportunity in the market.

Investing in blockchain technology offers a myriad of benefits ranging from enhanced transparency and efficiency to heightened security and innovation. As businesses and industries increasingly recognize the value proposition of blockchain, strategic investments in this transformative technology have the potential to unlock significant value and drive sustainable growth in the digital economy. These motivate the idea of TNQ Token. The option between blockchain and traditional finance investments depends on token holders' risk tolerance, investment objectives, and appetite for innovation. Integrating blockchain technology into traditional finance not only preserves the stability and regulatory certainty inherent in traditional methods but also introduces transformative opportunities for efficiency, transparency, and innovation. By harmonizing these elements, token holders stand to benefit from a comprehensive approach that optimizes risk-adjusted returns and capitalizes on the evolving global financial landscape. TNQ is dedicated to democratizing access to these integrated investment strategies for widespread participation and opportunity in the market. - Introduction

- TNQ Limited (TNQ)

- Financial Inclusion

- Diversification

- Innovation Exposure

- Transparency and Security

- Global Reach

- Liquidity

- TNQ Token

- The Foundation

- The Utility Use Cases

- Fund Utilization

- Technology Infrastructure and Facility

- Partnership Development

- Security and Compliance

- Talent Acquisition and Development

- Treasury Reserves

- Token Utility Optimization

- Existence

- VISION

- MISSION

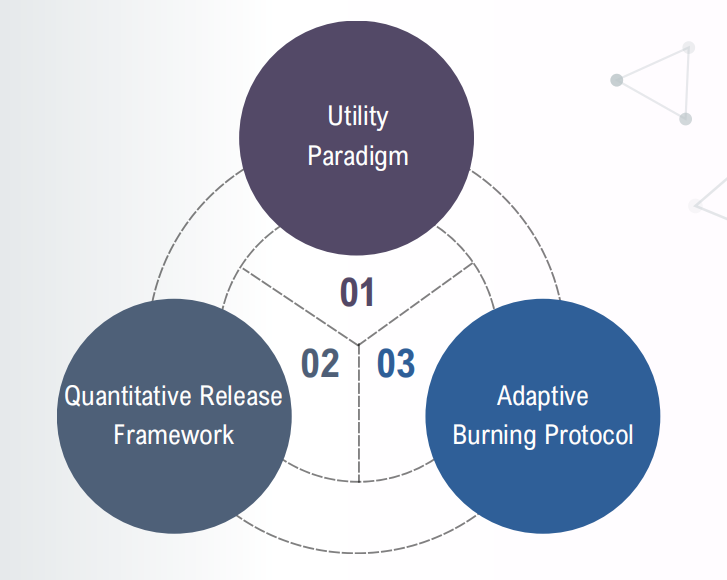

- Core Elements

- Blockchain-centric

- Decentralization

- Security

- Innovative Ecosystem

- Solution for All

- Wide Adoption

- Executive Team

TNQ Limited is an innovative marketplace or platform that revolutionizes financial trading by integrating advanced automated trading solutions through the introduction of TNQ Token. This transformative utility token empowers token holders to actively participate in decentralized and centralized trading strategies, access exclusive financial tools, and engage in the DeFi and CeFi Bot ecosystem. Token holders can capitalize on emerging opportunities, optimize risk-adjusted returns, and benefit from a collaborative environment designed to enhance trading effectiveness. TNQ Limited blends traditional financial principles with cutting-edge blockchain technology, delivering transformative DeFi and CeFi trading with automation that drive value and efficiency in the digital assets landscape.

Historically, traditional finance has been exclusive, presenting high barriers to entry for many individuals. Blockchain technology fosters greater inclusivity by allowing a wider audience to participate through fractional stakes, irrespective of geographic location or socioeconomic status. This democratization of finance opens new avenues for investment and economic participation.

Blockchain technology provides individuals with unprecedented diversification opportunities within the financial market, extending beyond traditional asset classes like stocks and bonds. By gaining access to a diverse range of asset classes-including cryptocurrencies, digital assets, individuals can spread their risk and potentially enhance returns by tapping into high-growth sectors that exhibit low correlation to traditional markets.

Participation in blockchain-based finance allows the public to benefit from the growth of innovative technologies and business models. Blockchain has the potential to revolutionize various industries, including finance, real estate, supply chain management and more. By investing in blockchain projects and companies, individuals can benefit from this innovation.

Blockchain-based projects offer transparency and security features that can enhance token holders’ confidence. The decentralized nature of blockchain ensures that transaction records are immutable and transparent, reducing the risk of fraud and manipulation. Smart contracts, a key feature of blockchain technology, can automate and enforce agreements, further enhancing security.

Blockchain projects have the potential to reach a global user base without the need for intermediaries or traditional financial infrastructure. This global reach opens up opportunities in emerging financial markets and allows token holders to diversify their portfolios across borders.

Participation in blockchain projects, including cryptocurrencies and decentralized finance (DeFi) solutions, offers high liquidity, enabling participants to buy and sell digital assets quickly and efficiently. This liquidity provides the flexibility for investors to adjust their portfolios in response to evolving market conditions or personal investment goals.

TNQ Token serves as the primary access key within the TNQ’s marketplace, allowing token holders to engage with DeFi and CeFi Bots provided by independent third party providers. Token holders use TNQ Token to interact with core marketplace functions, including decentralized and centralized trading strategies, transaction services, and advanced ecosystem tools, all of which are powered exclusively through token engagement. The practical applications of TNQ Token not only facilitate DeFi and CeFi Bot participation within the marketplace but also ensure that token holders can derive tangible benefits from its utilization and demand.

The value of TNQ Token is fundamentally linked to its active utilization and integration within the TNQ’s ecosystem. This connection enhances its utility and market demand in a robust environment where holders can optimize their investment strategies and benefit from innovative financial solutions. As participants engage with the platform, the demand for TNQ Token is likely to grow, further enhancing its value proposition. By aligning with the evolving landscape of decentralized finance, TNQ Token serves as a crucial asset for individuals looking to cultivate a sustainable investment approach that aligns with innovative market developments.

TNQ Token, a cryptographic token built on blockchain technology and tradable within its network, functioning as the core digital asset crucial to the ecosystem's operations. This token embodies the transferable functionalities outlined within its Smart Contract protocols, facilitating its use as an interoperable token within and beyond the platform. TNQ Token serves multiple utility use cases within the TNQ's ecosystem, designed to enhance user engagement and incentivize participation through various mechanisms.

The TNQ Token serves a critical role within the ecosystem, primarily as the medium for Bot Subscription Fees. Users can access advanced automated DeFi and CeFi Bot solutions, benefiting from tailored strategies while simultaneously driving the ecosystem growth. The subscription model directly links token usage to the platform’s development, where every subscription contributes to the refinement and expansion of the ecosystem’s tools, creating a cycle of growth powered by user participation.

Another significant use case is Staking participation. TNQ Token holders have the opportunity to stake their tokens for a specified period, thereby receiving Staking rewards in the form of TNQ Token from TNQ partnered Centralized Exchange. This mechanism encourages long-term engagement and stability within the ecosystem, as users are incentivized to maintain their holdings. By staking TNQ Tokens, participants contribute to the overall liquidity of the platform while positioning themselves to benefit from future developments and opportunities within the TNQ’s ecosystem.

In formulating the fund utilization strategy, TNQ prioritizes sustained growth and long-term viability as foundational pillars. A strategic allocation plan is essential to effectively navigate the complexities of the digital asset landscape. This deliberate approach is structured to ensure that every resource contributes meaningfully to advancing the ecosystem and broadening the utility use case and adoption of TNQ Token in the long-term.

This strategy is not driven by one-size-fits-all solutions but instead grounded in a profound understanding of current market dynamics, risk assessment and awareness of the evolving needs of digital-based community along the way. The following table outlines the sources of funds for the ecosystem’s development and growth:

Source of Funds Phase Pre-TGE Investors Private Sales Seed Round Strategy Round Round A The fund allocation focuses on key areas that drive operational excellence, technological innovation, and key expansion. These investments are carefully considered to ensure the ongoing development of a robust infrastructure, strategic partnerships, compliance frameworks, and the resilience of the platform, ultimately positioning TNQ for continued success in the competitive digital asset space. The following areas have been identified as critical to the platform's growth and stability:

Investments in technology infrastructure are fundamental to supporting TNQ’s vision for a robust and scalable platform. This facet underpins the seamless functionality of the platform and elevates the user experience within a secure and reliable environment for conducting transactions and managing assets. With a focus on scalability and resilience, continuously investing in the technology infrastructure is imperative to accommodate growing demand and adapt to evolving market dynamics, delivering a best-in-class user experience while maintaining the highest standards of security and reliability.

Partnership Development plays a crucial role in the expansion of the TNQ project by establishing strategic relationships with other blockchain platforms, institutions, and key industry players. These partnerships can lead to co-development opportunities, access to new markets, and the integration of complementary technologies that enhance the overall ecosystem. For instance, collaborating with prominent exchanges could improve the liquidity and accessibility of the TNQ Token, while aligning with established DeFi protocols could help expand the utility and use cases of the token within the broader decentralized finance space. Additionally, forming alliances with compliance and regulatory firms ensures that the project remains in line with global legal standards, which is critical for long-term sustainability. These partnerships provide valuable resources, expertise, and market presence for TNQ to scale faster and gain wider adoption across various sectors within the blockchain and digital asset ecosystems.

Rigorous security protocols and adherence to regulatory standards are integral components of TNQ Token's fund allocation for Security and Compliance. The protection of user assets and the integrity of our platform are paramount to maintaining trust and confidence among its user base. With timely-enhanced risk management practices in place, TNQ Token mitigates potential threats and vulnerabilities, safeguarding the long-term viability of its operations. This commitment to security and compliance not only minimizes risks but also enhances TNQ Token's reputation as a trusted and reliable player in the digital asset space. Moreover, the company acknowledges the necessary of this aspect from numerous failed projects in this growing industry, which underscores the importance of robust security measures and regulatory compliance. Capital allocation to this not only minimizes risks but also enhances overall credibility, thereby better positioning TNQ Token to attract and retain users, driving sustained growth and value creation in the long term.

A key focus of TNQ’s strategy is to attract and nurture a team of highly skilled professionals who can drive innovation and support the platform’s continuous growth. By recruiting experts in blockchain development, data analysis, and business strategy, TNQ will position itself at the forefront of technological advancements and meets evolving market demands. In addition to talent expansion, TNQ prioritizes ongoing professional development through advanced technical training, leadership development programs, and cross-functional collaboration initiatives. This strategic focus not only equips the core team with cutting-edge expertise but also ensures that the team remains adaptable to the rapidly evolving digital asset ecosystem.

Maintaining a treasury reserve is vital for ensuring financial stability and liquidity within TNQ's ecosystem. By allocating funds for capitalizing on opportunities, managing contingencies, executing market interventions, and pursuing strategic investments, resilience against market fluctuations and unforeseen events is significantly strengthened. This reserve acts as a strategic asset, enhancing operational flexibility, mitigating risks, and safeguarding the long-term viability of the ecosystem. Through prudent management of the treasury reserve, TNQ is better positioned to adapt to changing market conditions and support sustained growth, specifically in the digital landscape where constant adaptation is essential at every stage of development.

The TNQ Token’s functionality and value within the DeFi and Cefi Bot ecosystem are enhanced through user participation and decentralized engagement. As token holders interact with the platform’s autonomous DeFi and CeFi services, demand and utility are driven directly by user activities rather than centralized team efforts. This user-centered model reinforces token’s utility within the ecosystem without reliance on specific team initiatives.

Key performance indicators, such as the growth of the user base, total value staked (TVS), and transaction volume, are interdependent factors that contribute to the demand for TNQ Token. To foster sustained growth and resilience, the TNQ platform’s functionality adapts to user demand and activity within the ecosystem, where TNQ Token plays a critical role in subscriptions and access to DeFi and CeFi Bots and services offered by external providers. This decentralized and centralized, user-driven model encourages independent interactions across platform services.

As the intrinsic value of TNQ Token grows through increased user engagement and ecosystem traction, its utility and market position are further reinforced. This synergy is pivotal to the project's core focus, ensuring that TNQ Token remains a highly sought-after asset within the DeFi landscape. Ultimately, TNQ Token's value will reflect its widespread adoption and the active participation of its user base, driving ongoing growth and innovation in the DeFi and CeFi Bot ecosystem.

Looking ahead, the possibilities for further enhancing the utility of the TNQ Token remain promising. As the DeFi landscape continues to evolve, TNQ Token is positioned to benefit from emerging technologies and innovations that may unlock new use cases and functionalities. Potential improvements could include the integration of additional DeFi services, governance token, cross-chain compatibility, or expanded partnerships with other blockchain ecosystems, all of which would increase the token's versatility and demand. By remaining adaptable and forward thinking, TNQ Token aims to continuously offer compelling value to its holders, positioning itself to remain competitive and relevant in an ever-changing market environment.

To position TNQ Token as the leading utility token in the global automated trading landscape, driving innovation with cutting-edge Defi and CeFi Bot solutions in the Web 3 matrix.

To provide token holders with the access to a leading edge Defi and CeFi Bot ecosystem, delivering exceptional utility and long-term value through advanced automated trading solutions.

Foundational PillarsThrough blockchain integration, TNQ facilitates decentralized transactions between users, eliminating the need for intermediaries. Smart contracts of TNQ Token, verified by CertiK, govern the token transfers for transparent and trustless interactions. Additionally, the token minting occurs on a decentralized network, enhancing security and preventing unauthorized alterations to the token supply. This decentralized approach fosters a peer-to-peer ecosystem where participants have direct control over their token holding, promoting transparency and reliability.

Blockchain technology underpins TNQ Token's security framework, providing robust protection against cyber threats and fraudulent activities. The immutability of blockchain ensures every tamper-proof transaction records of TNQ Token, shielding token holders from unauthorized access or manipulation. By leveraging cryptographic techniques and consensus mechanisms, TNQ Token maintains data integrity and confidentiality where the on-chain data are publicly accessible. Blockchain-based security measures fortify TNQ's ecosystem, serving as a resilient foundation for secure and seamless transactions.

TNQ acts as a transformative link between traditional finance and blockchain innovation within the innovative DeFi and CeFi Bot ecosystem. It offers participants from diverse backgrounds access to a wide array of institutional-grade automated Bots that were previously inaccessible to retail investors. This enhanced accessibility not only drives participation but also amplifies broader token adoption within the ecosystem, fostering a positive feedback loop of growth and engagement. By democratizing the access to all, TNQ's strategic initiative promotes financial inclusion on a global scale. As more users engage with this next-gen trading and TNQ Token, the ecosystem benefits from increased participation and value creation, reinforcing token's pivotal role in bridging the gap between conventional finance and cutting-edge blockchain solutions.

TNQ Token aims for widespread adoption by offering user-friendly interfaces and intuitive ecosystem. By simplifying the participation protocols and continuously enhancing the utility use case, TNQ Token attracts a broad user base across the globe, including novice token holders and seasoned professionals. The ecosystem's accessibility extends to both traditional and blockchain-native token holders, fostering a vibrant ecosystem of diversified features and increased token adoption. The project team's commitment to usability and inclusivity accelerates the adoption of digital assets and reshapes the landscape of global finance.

TNQ's team comprises industry experts with diverse skill sets, expertise, and experience relevant to the cryptocurrency and blockchain industry, namely blockchain expert, financial analyst, investment strategist, legal and compliance specialist, risk managers, business development professional, communications and marketing specialist, operations and administration personnel, experience advisor and mentor, dedicated to driving the project forward. A cohesive and collaborative crypto investment team with complementary skill sets, diverse perspectives, and a shared commitment to excellence is essential for identifying, evaluating, and executing successful investment strategies in a rapidly evolving and dynamic market landscape.

Siaw Jun Kit - Chief Executive Officer (CEO)

Siaw holds a PhD in Finance & Investment, majoring in Technical Analysis. With over 11 years of extensive experience in currency trading, he has become an outstanding figure in the field. Transitioning over the past 7 years, he has gradually shifted his focus towards fund management.

With substantial knowledge in finance and a successful track record in currency trading, Siaw has developed proprietary manual trading strategies that have attracted millions of dollars in funds under management. He imparts these victorious strategies to currency traders through investment courses and private coaching. Siaw also serves as a speaker for technology and investment firms, functioning as a consultant with various private investment firms. Since 2019, he has leveraged his expertise to create an Artificial Intelligence trading system, providing comprehensive brokerage solutions to both individual and corporate clients.

With commitment to continuous professional growth, Siaw is actively pursuing internationally recognised certifications, including the Certified Financial Technician (CFTe) and Master of Financial Technical Analysis (MFTA) offered by the International Federation of Technical Analysts (IFTA). He is as well challenging the STA Diploma provided by the Society of Technical Analysts (STA) and the Chartered Market Technician (CMT) Programme offered by the CMT Association. These qualifications further underscore Siaw‘s dedication to excellence and his commitment to staying at the forefront of industry trends and practices.

As a best-selling author in Malaysia, he penned "Behind A True Trader", a book series that launched in 5 countries, available in English, Malay and Chinese, with a forthcoming masterpiece that explores relationships among financial instruments. Simultaneously, Siaw is working towards his next PhD in Investment Strategy Planning.

In 2023, marking his illustrious 11-year career, Siaw has assumed the role of CEO at a proprietary trading firm headquartered in Malaysia, where he adeptly oversees a team of numerous market analysts. Concurrently, he stands as the trailblazing CEO of TNQ, he exemplifies visionary leadership and has a demonstrated ability to build and inspire high-performance teams. His strategic direction and unwavering commitment to innovation have established TNQ as a pioneering force in fund tokenization, poised to revolutionize the industry landscape.

Michael Tan - Chief Operating Officer (COO)

Michael stands as a beacon of strategic prowess and operational finesse within the executive echelons. His illustrious career spanning over 5 years in the vanguard of leadership roles within the dynamic blockchain industry has endowed him with a wealth of insights and acumen. Michael’s tenure is punctuated by a series of triumphs, marked by his adept orchestration of organizational efficiency and unwavering dedication to bolstering profitability.

Within the hallowed halls of TNQ, Michael assumes the mantle of responsibility for every facet of daily operations, orchestrating a harmonious symphony of interdepartmental cohesion. His stewardship is hallmarked by an unwavering commitment to synchronizing all endeavours with the overarching vision and objectives of the company. With a laser focus on innovation and meticulous process optimization, Michael architects and executes operational strategies that not only enhance workflows and trim costs but also pave the path for sustainable growth in an ever-evolving industry landscape.

Yet, Michael’s leadership transcends mere operational acumen; it encapsulates a profound dedication to nurturing a culture of continuous improvement and employee empowerment. He is a stalwart advocate for initiatives that cultivate talent from within, championing the ethos of personal and professional growth among TNQ's workforce. Under his sage guidance, TNQ has metamorphosed its workforce into a formidable bastion of dynamism and adaptability, capable of surmounting any challenge and spearheading innovation with unwavering resolve. As the COO in TNQ, Michael embodies the very essence of TNQ's core values, serving as a catalysing force for operational excellence and propelling the company towards sustained growth amidst the crucible of today's competitive business milieu.

Chris Ooi - Chief Technolgy Officer (CTO)

Chris Ooi holds a Bachelor’s Degree in Internet Technology from Tunku Abdul Rahman University College (TARUC), Kuala Lumpur, Malaysia. His strong academic foundation supports his deep involvement in technology development, system design, and innovative digital solutions.

With over 9 years of experience in web development and hands-on expertise in information systems and digital infrastructure, Chris has cultivated a comprehensive understanding of how technology can enhance business efficiency and drive innovation. His work has extended across multiple countries — including Thailand, Vietnam, Malaysia, Singapore, and the Philippines where he has successfully led and delivered cross-border technology projects.

In addition to his broad IT expertise, Chris has spent the past 5 years specializing in blockchain technologies, focusing on smart contract development and decentralized solutions that empower transparency and automation in digital ecosystems across ASEAN. His continuous pursuit of learning allows him to stay at the forefront of emerging technologies and implement scalable, future-ready IT solutions.

Chris’s expertise spans project management, system integration, database management, and cybersecurity. Throughout his career, he has demonstrated a consistent dedication to excellence and innovation, delivering practical and forward-thinking solutions that accelerate digital transformation and create lasting value. His blend of technical mastery and strategic vision enables him to navigate complex challenges of TNQ with clarity, precision, and confidence.

Claudio Deaconu - Chief Legal Officer (CLO)

Claudio, with over 20 years of experience in international corporate law, is a distinguished legal expert in the global business landscape. His extensive expertise covers a wide array of industries, including cryptocurrency, fintech, e-tech, IT, and e-commerce, making him a highly sought-after legal advisor worldwide.

Claudio has completed over 350 international legal projects for clients in Australia, the United States, Canada, the United Kingdom, Europe, GCC countries, and Latin America. His deep understanding of diverse legal systems allows him to deliver comprehensive and tailored solutions across multiple jurisdictions. Claudio's specialized expertise includes drafting and negotiating international commercial agreements, ensuring compliance with national and international regulations, and providing robust legal frameworks for digital assets and blockchain technologies.

Claudio leverages his expertise in cryptocurrency and digital assets to help TNQ achieve legal and regulatory standards as the company’s Chief Legal Officer (CLO). By developing robust legal frameworks, navigating regulatory challenges, and ensuring compliance with evolving global standards, Claudio will foster innovation and protect consumer interests, positioning TNQ at the forefront of the blockchain industry.

Alwin Cheng - Chief Marketing Officer (CMO)

Alwin possesses over two decades of illustrious expertise in the dynamic realm of marketing, with an additional 4 years of experience in moderating, business development, and marketing for Web 3 projects in the crypto world. His journey through the corridors of the marketing world has been extraordinary, marked by numerous triumphs that have left an indelible mark on the industry's landscape. Beyond conventional marketing, Alwin demonstrates a unique talent for curating and steering international-grade events that resonate globally. Renowned for his visionary guidance, he has contributed his expertise to prestigious sporting spectacles such as the Professional Golfers' Association (PGA), Ladies Professional Golf Association (LPGA), Association of Tennis Professionals (ATP), and Women's Tennis Association (WTA) tournaments, crafting unforgettable experiences that captivate audiences worldwide.

Alwin's academic prowess mirrors his professional achievements, fortified by a Bachelor of Honors degree in Corporate Communication. This educational foundation serves as the bedrock upon which his stellar career has been erected, endowing him with a profound understanding of the intricate interplay between communication dynamics and corporate strategy. Empowered by this formidable blend of academic rigor and practical acumen, Alwin has spearheaded marketing campaigns that transcend mere promotion, skilfully weaving compelling narratives that resonate with audiences on a visceral level.

As TNQ's CMO, Alwin guides the marketing division with an unwavering commitment to innovation and excellence, positioning himself as a visionary architect. His strategies not only enhance brand visibility but also forge profound connections with the community. Alwin's leadership tenure is marked by relentless pursuit of excellence, navigating the evolving marketing landscape with agility and foresight. His indomitable spirit and dedication make him an indispensable asset, propelling TNQ towards unprecedented success and solidifying his legacy as a luminary in the realm of marketing.

- Trust & Security

- Institutional Partners

- Regulatory Environment

- CertiK: Smart Contract Auditor

- Carstoiu Remus Cosmin Law Firm: Legal Advisor

- Balaena Quant: Trading Service Provider

- Bitmart: Centralized Exchange

- Other Key Considerations

- Transparency & Disclosure

- Product and Protocol Details

- Conservative Risk Management

- Legal & Regulatory Compliance

- Consultation with Experts

- Compliant Product Design

- Conservative Regulatory Posture

- Real Time and Transparent Monitoring

- Cybersecurity

- Decentralization and Trust Models

- Securing Smart Contracts

- Security Tools and Auditing Practices

- Public and Immutable Data

- Cryptographic Key Management and Identity

- Evolving Threat Landscape

- Incident Response and Recovery

- Regulatory Compliance in Web 3

In the evolving landscape of decentralized finance (DeFi), operating within the DeFi Bot ecosystem requires collaboration with key institutional partners to ensure security, transparency, and efficiency. TNQ partners with reputable entities specializing in areas such as smart contract auditing, Web 3 compliance, market liquidity, and exchange integration. TNQ's alliances with reputable institutions highlight a strong dedication to upholding the highest standards of security, regulatory compliance, and operational integrity. These strategic partnerships create an environment where token holders experience transparency, efficiency, and security within the DeFi and CeFi Bot ecosystem, fostering trust and reliability in every interaction.

The introduction of new regulatory frameworks across various jurisdictions marks a significant advancement for the broader crypto ecosystem. These emerging regulations aim to provide greater trust, transparency, and operational standards for service providers operating within the digital asset space. By addressing key issues such as fraud prevention, market manipulation, and governance, these regulations promote innovation while ensuring that companies operate in a secure and compliant environment. As TNQ navigates these regulatory landscapes, aligning its governance and compliance strategies timely with these evolving standards remains a priority.

CertiK, a leading name in blockchain security, offers advanced auditing solutions that rigorously evaluate smart contracts and decentralized applications. By engaging CertiK to audit TNQ Token’s smart contracts, TNQ takes proactive steps to ensure the security and integrity of its ecosystem. Additionally, TNQ has achieved CertiK’s KYC Gold Verified Badge, a distinction awarded to projects whose core teams provide the highest level of verifiable background information and guarantees. CertiK’s detailed auditing practices help identify potential vulnerabilities, giving token holders confidence that their assets are protected by the most rigorous security standards in the decentralized finance space.

With over two decades of expertise, Carstoiu Remus Cosmin Law Firm specializes in high-tech legal sectors and provides tailored legal services to support TNQ’s compliance in the decentralized finance space. As a trusted legal advisor, the firm navigates the evolving legal landscape, addressing the complexities associated with digital assets and blockchain technologies. This involvement underlines TNQ’s focus on building a legally sound and secure ecosystem, offering stakeholders confidence in its regulatory standing.

Balaena Quant’s expertise in quantitative algorithmic trading and liquidity optimization is central to TNQ Token's secondary trading. By leveraging advanced market-making techniques, Balaena Quant contributes to maintaining balanced liquidity and favorable trading conditions at respective exchanges where TNQ Token is listed. The collaboration with Balaena Quant significantly enhances the trading experience for TNQ Token holders given their market insights and strategies that add depth to TNQ’s ecosystem.

Bitmart, a globally recognized digital asset exchange with CMC’s ranking of 16, serves over 10 million users and offers a transparent platform for trading. The token’s listing on Bitmart positions the token holders within a reliable and secure trading venue, expanding the market presence. This partnership amplifies TNQ’s accessibility and liquidity, reflecting the platform’s commitment to providing token holders with access to reputable trading environments. Bitmart’s standing as a trusted exchange reinforces TNQ’s vision of building a secure and user-centric ecosystem.

In addition to the key stakeholders involved, several other considerations are essential for TNQ's long-term success. Each component of the business ecosystem contributes to the overall strength and resilience of the project to continuously supports growth and adaptability. Ultimately, the interplay of these elements creates a dynamic and sustainable business model, positioning TNQ for enduring success in a competitive landscape.

TNQ believe the standards for transparency and disclosure in Web 3 finance should meet or exceed those in traditional finance (TradFi), as a new era demands better practices to foster trust and drive adoption. The commitment to transparency and disclosure within the Web 3 finance ecosystem, setting a standard that matches or surpasses the transparency levels observed in TradFi. This is particularly crucial in the context of the DeFi and CeFi Bot ecosystem, where users have clear visibility into how their assets are managed and traded.

The DeFi and CeFi Bot ecosystem represents a significant innovation within TNQ's platform, designed to enhance trading efficiency and liquidity management. These automated trading bots leverage advanced algorithms to execute trades based on market conditions, allowing users to capitalize on opportunities without the need for constant monitoring. TNQ strives to maintain transparency by offering detailed information about its products and protocols. This includes disclosing relevant dimensions such as features, functionalities, use cases, and risk factors. By providing comprehensive insights, token holders can make informed decisions and understand the intricacies of the offerings.

TNQ adopts a conservative approach to risk management, emphasizing prudence and caution in its operations. By prioritizing risk mitigation and avoidance, TNQ seeks to create a stable and secure environment for its users and stakeholders. This involves implementing thorough due diligence processes, conducting regular risk assessments, and establishing clear protocols for identifying and addressing potential vulnerabilities.

TNQ takes legal and regulatory compliance seriously, recognizing it as a fundamental pillar of its operations and a key factor in building trust with users and stakeholders. The company diligently adheres to applicable laws and regulations across all jurisdictions in which it operates, positioning itself in an environment that its practices align with the highest industry standards.

To ensure compliance with legal, tax, and regulatory requirements, TNQ consults with a diverse array of experts in these fields. By engaging specialized legal, tax, and regulatory advisors, TNQ taps into a wealth of knowledge and insights that equip it to navigate the intricate and ever-evolving regulatory landscape effectively. Given that the digital assets landscape is complex and relatively new, these expert consultations are essential for staying ahead and informed decision-making.

TNQ invests significant effort in designing its ecosystem functionalities at every stage of the development process. This commitment involves embedding legal and regulatory considerations into product design from the outset, which helps to create offerings that are not only innovative but also fully aligned with applicable laws and regulations. By adopting a compliance-by-design approach, TNQ diligently identifies and addresses potential compliance issues before they arise, effectively minimizing the risk of non-compliance and reducing the likelihood of regulatory scrutiny.

The conservative stance allows TNQ to navigate the complex regulatory landscape with confidence, as it emphasizes thorough due diligence and proactive engagement with regulatory authorities. By continuously monitoring evolving regulations and adapting its practices accordingly, TNQ reinforces its dedication to maintaining the highest standards of compliance and governance. Furthermore, this approach enhances TNQ's reputation as a responsible and reliable player in the digital finance space, attracting users who value security and integrity in their financial interactions. Ultimately, this key element serves as a foundation for sustainable growth and long-term success in an ever-evolving market.

TNQ’s official website offers real-time access to crucial data, providing users with comprehensive insights into the ecosystem. This includes live updates on the total minted amount, market circulating supply, total staked amount, historical data on token minting, along with a dedicated burn metrics to track the total burned tokens, offering transparency regarding the token's distribution. This commitment to transparency and accountability underscores company's dedication to maintaining trust and integrity within its community and token holders.

As the Web 3 ecosystem expands, so do the cybersecurity challenges unique to this decentralized, blockchain-driven environment. Traditional cybersecurity principles are not fully equipped to address the complexities of the Web 3 landscape, necessitating specialized approaches to protect decentralized applications (dApps), smart contracts, and user assets. TNQ’s cybersecurity strategy has been crafted with these considerations in mind, ensuring a secure and resilient platform for users. This section outlines the critical differences in Web 3 cybersecurity and the strategies employed to safeguard TNQ Token and its users.

TNQ Token is built within a decentralized Web 3 infrastructure, where trust is shifted from centralized authorities to blockchain protocols. Security efforts for TNQ Token focus on ensuring the robustness of consensus mechanisms, distributed networks, and protocol integrity. Unlike traditional systems with centralized oversight, TNQ Token’s security model is based on validating trustless interactions, cryptographic proofs, and distributed consensus, minimizing reliance on third parties and maximizing security at the protocol level.

TNQ Token’s smart contract source code on Etherscan:

https://etherscan.io/token/0x47E5C76F155083F1aee39578311a2A5FaA938A82#c ode

At the heart of TNQ Token’s functionality are smart contracts, which facilitate self-executing transactions without intermediaries. These contracts are immutable upon deployment, meaning any vulnerabilities are permanent and could lead to asset loss. To protect TNQ Token, comprehensive smart contract audits are conducted, focusing on potential vulnerabilities such as reentrancy attacks, integer overflows, and logical errors. Regular testing and code reviews are essential to maintaining the resilience and security of TNQ Token’s smart contracts.

TNQ on CertiK:

https://skynet.certik.com/projects/triniqueTNQ Token’s decentralized nature requires specialized tools to secure smart contracts, verify blockchain integrity, and monitor transaction flows. Leading-edge auditors like CertiK examine token’s smart contract code for vulnerabilities, while blockchain explorers and on-chain analytics further aid in monitoring network activity and identifying potential threats before they can impact the TNQ’s ecosystem. Combining thorough code audits, continuous monitoring, and automated alerts ensures TNQ remains a secure and resilient Web 3 platform.

TNQ Token's transactions operate on a transparent blockchain ledger, where transaction data is public and immutable. This transparency is crucial for user trust but also necessitates careful handling of data privacy and sensitive information. Advanced cryptographic techniques, such as zero-knowledge proofs, allow token holders to engage privately while preserving the blockchain’s transparency. This approach ensures compliance with privacy standards without compromising the platform’s integrity.

In the TNQ’s ecosystem, user identities are defined by cryptographic public-private key pairs, offering users unparalleled control over their assets. However, secure key management is critical, as there are no centralized password recovery options. TNQ emphasizes robust key management solutions and secure recovery methods, to safeguard assets against compromised keys and ensure secure identity management.

The Web 3 landscape introduces new attack vectors, including smart contract exploits, flash loan attacks, 51% attacks, and private key phishing. The token’s security framework addresses these emerging threats through regular vulnerability assessments and threat modeling. Continuous monitoring of Web 3 threat patterns allows TNQ to adapt its defenses proactively, protecting against both project-specific and ecosystem-wide threats.

Blockchain’s immutable nature requires a proactive cybersecurity approach, as transactions are irreversible. TNQ places significant emphasis on preventive measures, including rigorous testing and audit trails. An incident response plan incorporates real-time monitoring of on-chain activity, enabling swift detection and mitigation of potential exploits before they impact token holders. This proactive approach minimizes the risk and impact of security breaches.

Web 3 exists within a rapidly evolving regulatory environment, presenting unique challenges for privacy, anonymity, and decentralized governance. TNQ is committed to compliance with relevant data privacy standards, such as General Data Protection Regulation (GDPR), and financial regulations. Active engagement with regulatory bodies positions TNQ to stay compliant while preserving Web 3’s decentralized identity features. This focus on compliance allows TNQ to operate securely within the evolving legal landscape, with an emphasis on user security and regulatory alignment.

- Tokenomics

- Overview

- Specifications

- Tokenomics

- Token Distribution

- Release Model

- Burning Mechanism

- Tokenomics Evaluation

- Intercorrelated Dynamics

- TNQ Token Acquisition

- DeFi and CeFi Bot Mechanism

- Staking Mechanism

The TNQ Token stands at the center of the DeFi and CeFi Bot ecosystem, functioning as the critical utility token that drives user engagement, ecosystem functionality, and overall growth. As a digital asset designed to fuel decentralized automated trading solutions, TNQ Token enables seamless interactions within the platform, offering users an innovative tool to access and participate in the growing decentralized finance landscape. It empowers users to engage in a wide range of advanced DeFi and CeFi Bots, creating limitless opportunities for portfolio growth and diversification.

TNQ Token is essential for unlocking key features within the DeFi and CeFi Bot ecosystem. Users leverage the token to access and subscribe to various DeFi Bots, where subscription fees are paid in TNQ Token, creating a continuous demand for the asset. Further functionalities include token Staking, where participants can lock their TNQ Token in hand to earn Staking rewards, which is also paid in the form of token. These multiple utility layers strengthen the token’s core role in the TNQ's ecosystem, aligning user participation with token value creation.

The security and trust framework surrounding TNQ Token is reinforced by partnerships with top-tier blockchain auditors, such as CertiK, which rigorously audits the smart contracts underlying TNQ Token. This auditing process ensures the technical integrity of the ecosystem and guarantees that the token operates within a secure, transparent, and trustworthy environment. With CertiK’s KYC Gold Verified Badge, TNQ has demonstrated its proactive stance in upholding the highest levels of integrity and risk mitigation, strengthening a strong sense of security across all facets of the ecosystem for stakeholders and compliant operations within the decentralized landscape.

The TNQ Token is strategically positioned to capture a significant share of the decentralized finance market, leveraging its unique role. As more participants engage with the TNQ’s ecosystem, demand for TNQ Token will be linked to the platform’s role as a marketplace for accessing third-party DeFi and CeFi Bots and services. TNQ Token’s integrated utility features provide token holders with essential access to TNQ’s DeFi functionalities, reinforcing its role within the ecosystem as a functional, service-oriented asset. TNQ’s ecosystem is designed to be self sustaining, with a decentralized model that allows token holders to engage independently with various platform features. The ecosystem’s design minimizes reliance on ongoing team efforts, instead enabling token utility to grow through organic user activity and decentralized participation.

TNQ Token’s value proposition is further enhanced by its strong market positioning as a tool that bridges innovative DeFi solutions with practical user benefits. This combination of real-world utility, strategic partnerships, and a user-driven growth model makes TNQ Token a highly attractive asset for both traders and investors seeking to participate in the evolving DeFi landscape.

With a fixed supply cap of 1,000,000,000 TNQ Token, the token’s structure reinforces its role within the ecosystem as a medium for accessing services. The burning mechanism is intended to maintain operational efficiency and ecosystem stability by managing token supply in response to platform demand, thereby aligning token availability with the system's utilization needs over time.

TNQ Token is designed as the backbone of the DeFi and CeFi Bot ecosystem, functioning as a utility token that facilitates access to various services and features within the platform. Its primary role is to serve as the currency for subscribing to exclusive DeFi and CeFi Bots, unlocking advanced automated trading strategies and features. Users must hold and use TNQ Token as a means of access, creating a seamless connection between the token's utility and the overall DeFi and CeFi Bot ecosystem adoption. This utility-centric model keeps TNQ Token remains integral to ecosystem participation, aligning its value with the unique services it provides.

As the TNQ DeFi and CeFi Bot ecosystem expands, the demand for TNQ Token will be driven by their essential role in subscribing advanced DeFi and CeFi Bots and other ecosystem features. This organic demand is directly linked to the token's utility, grounding its value in real use cases within the platform rather than pure speculation. With every new user engaging with TNQ’s automated trading solutions, the utility of the token becomes further reinforced, maintaining a cycle of sustained value creation linked to ecosystem growth.

4.1.2.1 Overview

This section outlines the economic model and key manual of TNQ Token, the one and only native utility token for the TNQ’s ecosystem. TNQ Token secures the platform’s functional capabilities by facilitating bot subscription fees, providing utility, and serving as an incentive mechanism across TNQ's blockchain infrastructure. Below, a detailed overview of the token’s design, minting, distribution, burning, and release schedule is outlined to provide stakeholders with insights on how the TNQ Token aligns with the ecosystem’s planning.

4.1.2.2 Disclosure

The information provided in this paper is preliminary and subject to modification. Furthermore, this document may contain forward-looking statements related to future events or TNQ's projected performance, including but not limited to the anticipated growth of TNQ's ecosystem, business developments, strategic initiatives, and ongoing or potential projects. These forward-looking statements reflect TNQ management's expectations and assumptions as of the date of this paper and are not guarantees of future performance. They inherently involve risks and uncertainties that could result in actual outcomes deviating materially from those anticipated. TNQ disclaims any obligation to update these statements. While forward-looking statements are based on current predictions, actual results and future events could diverge substantially. Readers are advised not to place undue reliance on these statements.

4.1.2.3 Utility

Tokenomic plays a central role in defining the practical value and function of a token within its ecosystem, determining on how it can be strategically applied. This framework establishes the parameters for utility and incentivization mechanisms for user engagement. For detailed insights into these applications, refer to Section 2.2.2 - The Utility Use Cases.

4.1.2.4 Key TNQ Properties

The TNQ Token economy incorporates several core attributes that secure its utility and support growth. Primarily, the token follows a demand-driven unlocking model for specific allocations, enabling quick access to tokens for ecosystem, marketing, liquidity provisioning, and Staking rewards. The DeFi and CeFi Bot subscription model plays a pivotal role in strengthening TNQ’s ecosystem, where subscription fees collected in TNQ Token are a critical component fueling the burn mechanism, strategically designed to achieve long-term deflationary impact.

The TNQ Token is released based on a decreasing regression emissions curve specifically designed to gradually suppress excessive token that will impede price over time. This model, similar to Bitcoin’s philosophy of emissions, limits TNQ supply and maintains scarcity over the token’s release schedule to avoid market flooding and cultivate a sustainable token economy. The TNQ Token’s maximal total supply of 1 billion tokens are established in advance across classes to support tactical growth and operational needs. Each class has specific vesting and release schedules to ensure equilibrium supply and demand dynamics, while a demand-driven unlocking model is applied where appropriate. The release schedule employs a reducing exponential approach, especially for community allocations and investor-based unlocks, to bolster ecosystem engagement without further market saturation. Community-driven token releases begin with a small percentage at the Token Generation Event (TGE) and are subsequently unlocked at pre-determined intervals to promote user participation while keeping price stability alive. Investor tokens are similarly structured with vesting timelines tailored to long-term growth to scale the ecosystem efficiently.

TNQ Token Distribution

Deflationary Burn Protocol

The distribution framework of the TNQ Token is nurtured around a comprehensive strategy that comprises multiple phases and is designed to adapt dynamically to demanding secondary market price. This framework consists of distinct release schedules and vesting periods that govern the availability of tokens to various stakeholders to facilitate a durable, reliable supply mechanism and upward valuation model. The distribution of TNQ Token spans various categories that each support strategic objectives within TNQ’s ecosystem. Of the total supply, 1 billion tokens are allocated across teams, investors, ecosystem development, marketing, community initiatives, liquidity, and Staking.

To further optimize TNQ Token’s distribution model, each allocation is governed by a tokenomic structure with built-in mechanisms for controlled release and flexible deployment. Through a fusion of exponential decay release and demand-driven vesting schedules, TNQ facilitates a gradual infusion of liquidity into the ecosystem to synchronize with both market and ecosystem extension trajectories. Key components, such as lock-up periods for team and investor tokens, are implemented to mitigate premature supply influx, while community-driven allocations and liquidity provisioning are strategically aligned to support transactional fluidity and secure market access. In alignment with the token distribution strategy, a deflationary burn protocol is employed to periodically reduce circulating supply in response to reinforce long-term value appreciation as adoption scales.

Investment Round Investor List Allocation Price per TNQ Vesting Period (Post-TGE) Release Schedule (Exponential Decay) Funding Schedule Private Sales Private Individual x1 2% $0.20 12 months 36 Months SEPT’ 23 Seed Round Private Individual x2 2% $0.40 12 months 30 Months NOV’ 23 Strategy Round Private Individual x5 3% $0.60 12 months 24 Months JAN’ 24 Round A Mirac Financial Ltd., Omada Global Ltd. 5% $0.80 12 months 18 Months FEB’ 24 The TNQ Token distribution framework is structured to ensure that tokens are made available in alignment with ecosystem growth and user participation. Token allocations follow a release schedule intended to maintain a balanced supply within the ecosystem, supporting ongoing platform utility without creating sudden supply shifts. To ensure token allocation for investor category aligns with the project’s longevity and stability, the earliest participation stages, such as the private sales and seed round, feature longer vesting schedules. This approach incentivizes early investors with better entry prices while promoting market stability through gradual token releases over an extended period. Each funding round is strategically structured to deliver value across various phases of TNQ’s growth, achieving strong alignment between investor objectives and TNQ’s development trajectory.

The TGE will culminate in a public token release, with the Initial Exchange Offering (IEO) slated in March 2024. This phase represents a critical juncture for TNQ to establish its public footprint and officially launch liquidity on an exchange to initiate active market engagement. The TGE will set the foundation for organic price discovery and a sustainable liquidity pool to catalyze trading activity among the global crypto community. The tokens for this category will be distributed according to the below schedule:Category Release Basis Release Period Allocation Amount Private Sales Exponential Decay-Based Release % MAR’ 25 - FEB’ 28 2.00% 20,000,000 TNQ Seed Round Exponential Decay-Based Release % MAR’ 25 - AUG’ 27 2.00% 20,000,000 TNQ Strategy Round Exponential Decay-Based Release % MAR’ 25 - FEB’ 27 3.00% 30,000,000 TNQ Round A Exponential Decay-Based Release % MAR’ 25 - AUG’ 26 5.00% 50,000,000 TNQ The team allocation of 5% follows a structured release schedule designed to stabilize token availability within the ecosystem, supporting ecosystem sustainability and operational continuity. This schedule ensures a predictable release rate that aligns with ecosystem requirements, independently of any market speculation. The vesting period framework minimizes the likelihood of premature token sales. According to the project's development planning, the vesting schedule takes into account the optimal timing for token release to align with key milestones, maturity of the project, and market sentiment. The tokens for this category will be distributed according to the below schedule:

Release Period Allocation Amount SEPT’ 25 - AUG’ 27 Exponential Decay-Based Release % Exponential Decay-Based Release (TNQ) Total 5.00% 50,000,000 TNQ The community allocation comprises 38% of the total token supply and is strategically designed to engage users and promote long-term participation. The release schedule starts with an initial 5% release at the TGE, followed by 24-month exponential decay release of which 8% will be released 24 months post-TGE, another 10% at 48 months, and a final 15% at 72 months after the TGE, all tied to current market prices at the time of release. This tiered approach is intentionally designed to maintain token supply stability, each release tranche can be synchronized with new feature launches, community campaigns, or cross platform collaboration, allowing TNQ to precisely benefit user at every stage. The tokens for this category will be distributed according to the below schedule:

Release Period Allocation Amount Phase 1 MAR’ 24 5.00% 50,000,000 TNQ Total 5.00% 50,000,000 TNQ Release Period Allocation Amount Phase 2 MAR’ 26 - FEB’ 28 Exponential Decay-Based Release % Exponential Decay-Based Release (TNQ) Total 8.00% 80,000,000 TNQ Release Period Allocation Amount Phase 3 Mar 2028 - Feb 2030 Exponential Decay-Based Release % Exponential Decay-Based Release (TNQ) Total 10.00% 100,000,000 TNQ Release Period Allocation Amount Phase 4 MAR’ 30 - FEB’ 32 Exponential Decay-Based Release % Exponential Decay-Based Release (TNQ) Total 15.00% 150,000,000 TNQ The ecosystem fund retains 15% of the token supply, which is preserved for expanding TNQ’s operational roadmap in business development, Tokenomics innovation, and infrastructure upgrade. The tokens for this class operate on a demand-driven unlock mechanism with no vesting period, empowering TNQ to allocate resources precisely when and where they are needed most to optimize the effectiveness of every token utilized in supporting the ecosystem's growth

Release Period Allocation Amount Release on Demand 15.00 % 150,000,000 TNQ Total 15.00% 150,000,000 TNQ The marketing allocation, set at 3.5% of the total token supply, will be fully unlocked at TGE, is designed to strategically leverage TNQ Token for promotional activities and enhance brand visibility. By utilizing TNQ Token as a reward mechanism, the project can incentivize user engagement through various initiatives, including referral bonuses, social media contests, and loyalty programs. For instance, during the launch phase, participants may earn TNQ Token by engaging in community events or sharing promotional content, which fosters organic growth and strengthens community involvement. This allocation will serve to boost awareness of TNQ and cultivate a sense of ownership among early adopter within the ecosystem.

Release Period Allocation Amount Release on Demand 3.50 % 35,000,000 TNQ Total 3.50% 35,000,000 TNQ The liquidity allocation, representing 8.5% of TNQ’s total token supply, will be fully unlocked at TGE and release based on demand, plays a pivotal role in establishing a solid foundation for market accessibility on key CEX platforms. With this liquidity reserve fully accessible from TGE, market participants can execute trades without disruptive slippage. This foresight is crucial to benefit both TNQ and its community by driving investor interest, balancing supply-demand dynamics, and creating a fair trading environment.

Release Period Allocation Amount Release on Demand 8.50 % 85,000,000 TNQ Total 8.50% 85,000,000 TNQ The Staking Allocation in TNQ, representing 18% of the total token supply, is pivotal in supporting TNQ's Proof-of-Stack (PoS) mechanism, part of TNQ's minting model where users “lock” tokens to secure ecosystem integrity and earn rewards. When tokens are staked, they participate directly in the ecosystem’s stability, with new tokens released in correlation with the staked amounts and release schedules. This allocation is dynamically responsive as tokens are unlocked based on specific staking demand to align the rate of token emission with user commitment levels, this provides flexibility to TNQ to manage liquidity without breaching its capped supply. The PoS mechanism will affirm the staked tokens support both liquidity and security requirements to maintain a predictable release curve that prevents sudden market surges or supply impact. This approach serves a crucial aspect that strengthens the TNQ ecosystem’s foundational infrastructure and to promote in motion token circulation within fixed supply parameters.

Release Period Allocation Amount Release on Demand 18.00 % 180,000,000 TNQ Total 18.00 % 180,000,000 TNQ The 18% of total supply preserved for Staking yield is strategically designed to be distributed on smart contract layer, with a yield of 0.8% per 45-day Staking cycle or Annual Percentage Rate (APR) of 6.4%. As this allocation progressively supports the PoS yield, once the allocation is fully utilized, the project team will be purchasing tokens directly from the market to maintain ongoing rewards for staked tokens. This forward-thinking approach highlights a dynamic strategy: rather than relying passively on token burning, which fluctuate based on user uptake, TNQ actively intervenes to meet Staking demand and enhance market participation. The buyback mechanism will establish a responsive loop where both yield sustainability and token market demand are managed strategically within a fixed supply framework.

The Staking yield is computed as below

Risk Premium is the additional return to investors to compensate for the additional risk that investors have to takeAssuming the risk free rate at 4% per annum, ß at 1 and risk premium at 2% per annum: Staking Yield = 4.5% + (1 * 2%) = 6.5% (Annualised) ≈ 0.8% (every 45 days)

Remarks:

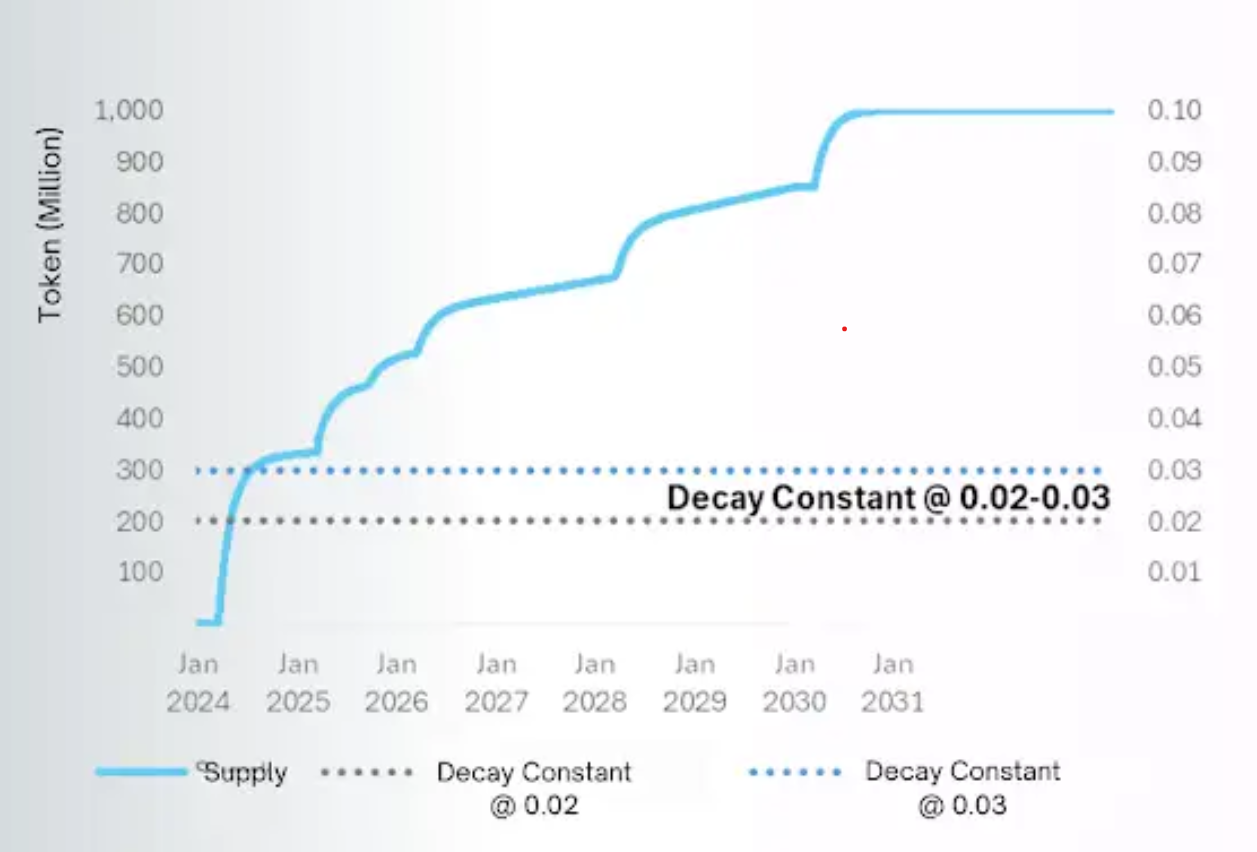

Token release for Staking reward will gradually increase as token under Staking increases over time, capped at 180 million. The token release follows a concave curve as market participation in Staking is expected to increase exponentially as time progresses.TNQ adopts a hybrid token release approach, combining an exponential decay model with an on-demand release mechanism. This balanced strategy ensures controlled distribution where applicable, while allowing flexibility to meet ecosystem demands. The exponential decay model is designed to manage the distribution of tokens over time, with the release rate decreasing exponentially as time progresses. The formula can be expressed as follows:

Token Release (Exponential) = Allocated Supply * Euler's Number ^ (-Decay Constant * Time Elapsed)

Where:

1. Allocated Supply = The supply allocated for each function, such as ecosystem development and community development

2. Euler's Number = Approx. 2.71828

3. Decay Constant = The rate of decay at 0.02 - 0.03, which translates to a release window from 24 to 36 months

4. Time Elapsed = Count of Months Remarks:

Remarks:

The release of TNQ follows a pattern of exponential decay, where the release of TNQ will reduce gradually at a decay constant of ≈0.02 - 0.03 as time passes, thereby creating a scarcity in TNQ as demand increases from the utility function of TNQ.4.1.5.1 Overview

TNQ’s tokenomics framework is critically engineered to optimize resource allocation, facilitating scalable growth and adaptive responsiveness to market demands and user participation. This dynamic model, built to evolve with the ecosystem, aligns distribution mechanisms and emission schedules to support liquidity, Staking, and incentive structures essential for decentralized finance (DeFi) application. A well-calibrated deflationary model incorporates both scarcity controls and mechanisms to absorb tokens over time, balancing market circulation to protect intrinsic value. These built-in economic incentives are to support a semi-man made appreciating value for TNQ Token, driven by rational supply-demand interactions that foster sustainable upward valuation momentum.

In the TNQ’s tokenomics, a unique burning mechanism governs the tokens collected from subscription process for DeFi and CeFi Bot services.

Illustration for DeFi and CeFi Bot subscription:

• When users initiate a DeFi or CeFi Bot subscription, they pay a 1% subscription fee in TNQ Token

• The amount of TNQ Token required is directly proportional to the current aggregated TNQ Token price on respective centralized exchanges (CEX). This price is verified in real time to ensure accuracy in subscription feesThe TNQ system interfaces directly with CEX APIs to fetch the live price of TNQ Token at the moment of subscription. This price data dynamically determines the TNQ Token required for the subscription fees. To ensure reliability, the system will verify prices from multiple CEXs and use an average price to prevent potential anomalies.

Example Calculation:

For a $10,000 subscription to a DeFi or CeFi Bot:

• Subscription fee: 1% of $10,000 = $100

If the TNQ Token price on the CEX is:

• $1: The user will need to pay 100 TNQ Token

• $0.50: The user will need to pay 200 TNQ Token

• $2: The user will need to pay 50 TNQ Token4.1.5.2 Burn Rate Illustration

A dynamic burning mechanism will systematically reduce the token circulating supply in response to demand milestones and current supply metrics. An initial burn rate of 50% will be applied, effectively reducing the circulating supply to bolster long-term token value. This rate is dynamic, structured to adjust in line with the relationship between actual demand and a predefined release schedule. The burn rate, at any time, is calculated as the model below:

Base Burn Rate *

Token for BurningWhere:

1. Token Pool refers to the cumulative sum of TNQ Token collected from the bot subscription fees

2. Base Burn Rate at 50%

3. Demand factor can be defined as a weighted average growth of (i) change in bot subscription amount, (ii) change in transaction volume in respective CEXs, and (iii) change in the total sum under Staking, with a weight of 40%/40%/20% respectively and calculated on a real-time basis

4. Adjustment factor is defined as the real-time change in the market sentiment

5. Burn Cap = The predefined maximum amount of tokens that can be burned throughout the project life cycle. Burn cap is a function of expected inflation in the next 10 years and is derived as the future value of an expected inflation rate of 2.5% per annum, which projects to approximately 28.02% of the total supplyRemarks:

Both demand and adjustment factors are simulated to be normally distributed to introduce a degree of randomness or variability into the burn rate calculation to simulate real-world conditions where factors like demand and market sentiment can fluctuate, subsequently to assess the volatility of the burn rate.In this model, the burn rate responsively shifts depending on the variance to modulate supply reduction proportionally with market demand. When actual demand could not cope to the expected outcome from supply release schedule, the burn rate intensifies, thereby reducing circulating tokens to match stagnant demand. Conversely, if factual demand surpass the supply release schedule, the burn rate quantitatively adjusting downward to preserve token availability without further reduction. This adaptive burn framework underpins TNQ’s price-supply dynamics by aligning supply contraction with demand fluctuations. Over time, the result is a self-balancing mechanism that amplifies token scarcity when demand spikes to sustain an attractive price equilibrium over the project life cycle.

The burning mechanism incorporates an adaptive function that recalibrates based on actual token demand in relation to maximum supply parameters and tiered release schedule, as well as thresholds for short-term volatility adjustments, triggered if the demand-supply variance deviates substantially from historical averages over predefined moving intervals. To streamline operations, all tokens collected from subscription fees, which occur continuously, will be accumulated and burned once monthly, on the 28th. At the close of specified intervals, the function rebalances to address natural ecosystem growth patterns, integrating scaling factors that account for the expanded adoption base and ecosystem needs to scale the burn percentage in line with market depth and adoption rates.

Following the adaptive burn model, the remaining tokens will be subjected to burn events scheduled at specific project milestones to correspond with sustained adoption metrics, measured by both on-chain activity and demand intensity. In addition to burn rates adjusted for market dynamics, these remaining tokens in the TNQ's reserve will be phased out gradually, preserving a balanced liquidity pool that supports market depth. This strategic liquidity management will involve deploying a portion of the remaining tokens into liquidity pools across various CEXs for long-term strategic objectives.

Tokenomics forms the foundation of TNQ’s ecosystem, balancing supply and demand through a structured release schedule, utility-based mechanisms, and a targeted burning model. Each element of TNQ’s tokenomics is interdependent, designed to enhance value and encourage strategic use of the TNQ Token, especially as it gains traction within the DeFi and CeFi Bot trading ecosystem. Here, TNQ explore each of these interlocking components and demonstrate how they drive demand, support token price stability, and foster sustainable growth.

4.1.6.1 Utility of TNQ Token

The TNQ Token serves as a multi-functional asset within TNQ’s ecosystem, primarily as a medium for subscription services within TNQ’s DeFi and CeFi Bot framework. This utility layer is pivotal to sustaining demand, as token holders actively use TNQ for two primary purposes:

• Subscription to DeFi or CeFi Bots: Each user accessing TNQ’s automated trading bots is required to subscribe with a nominal fee, which is paid exclusively in TNQ Token. This requirement creates a direct demand for the token, as more users seeking passive trading opportunities or investment growth must purchase TNQ Token to access these services.4.1.6.2 Release Schedule and Supply Order Dynamics

The release schedule of TNQ Token has been meticulously designed to ensure a steady but limited supply entering circulation, leveraging a formula-based release structure. By restricting the release rate, TNQ strategically controls token availability to create a demand-driven model where scarcity supports token appreciation.

Key Components of TNQ’s Release Schedule:

• Moderate Diminishing Supply: TNQ’s tokens are released gradually over multiple phases, allowing for a controlled flow of new tokens into circulation. The early investment stages, such as Seed and Private rounds, feature extended vesting schedules. This approach deters rapid sell-offs and creates a stable, controlled release rate that maintains a smaller supply relative to demand growth

• Algorithmic Release: The release schedule follows a decaying release formula, where each subsequent phase releases fewer tokens than the previous, creating a shrinking supply curve over time. This design ensures that, as TNQ’s user base expands, the available supply remains increasingly limited, fostering a natural supply-demand imbalance favoring token holders

• Demand-to-Supply Price Impact: With a consistently decreasing release rate, TNQ minimizes inflationary pressures on its token. Combined with utility-driven demand, the release schedule of TNQ Token is structured to align token availability with user adoption rates and ensure a stable supply within the ecosystem. As platform participation grows, the system’s-controlled token issuance intends to maintain a balanced environment for all ecosystem participants4.1.6.3 Burning Mechanism as the Ultimate Deflationary Measure

A crucial component in TNQ’s tokenomics lies within the burning mechanism. Designed to actively reduce the circulating supply, the burn strategy is synchronized with user activity and token usage, amplifying the deflationary effect as the platform grows. By systematically removing TNQ Token from circulation, the burning mechanism helps maintain scarcity and fosters a price-supporting effect over time.

Burn Rate and Accelerated Burn Formula:

• Transaction-Linked Burn: Each time a user subscribes to a DeFi or CeFi Bot or completes a transaction, a portion of the transaction fee is allocated for burning. This implies that every TNQ Token spent on fees gradually reduces the circulating supply. The burn rate is linked to platform activity; as more users transact, the burn volume accelerates, directly proportional to usage